Showcase

FX Risk Management

The FX Risk Management report analysis is a comprehensive tool designed to help businesses keep track of all their trading activities in financial market products, such as forward exchange contracts and currency options. The report provides users with the ability to monitor their hedging ratios versus set benchmarks, analyze achieved hedging rates through time, and manage counter-party trading and credit risk. This information is critical in helping businesses to manage their financial risk exposure, enabling them to make informed decisions that drive profitability and growth.

Furthermore, the FX Risk Management report analysis offers a range of features that make it an efficient and effective tool for managing financial risk. The report allows users to customize their visualizations according to their specific needs, enabling them to focus on specific areas of interest. Additionally, the report provides a range of visualizations that make it easy to visualize complex data, enabling users to quickly identify trends and patterns in financial data.

What our Students Say

Latest Showcases

Loading

Frequently Asked

Questions

What’s the difference between a free account and a paid plan?

Do I need to know anything about data science or data analytics to get started with Enterprise DNA?

How will I be charged?

Can I get an invoice for my company?

Are refunds available?

Will AI take over the world and make data skills worthless?

Get full access to unparalleled

training & skill-building resources

FOR INDIVIDUALS

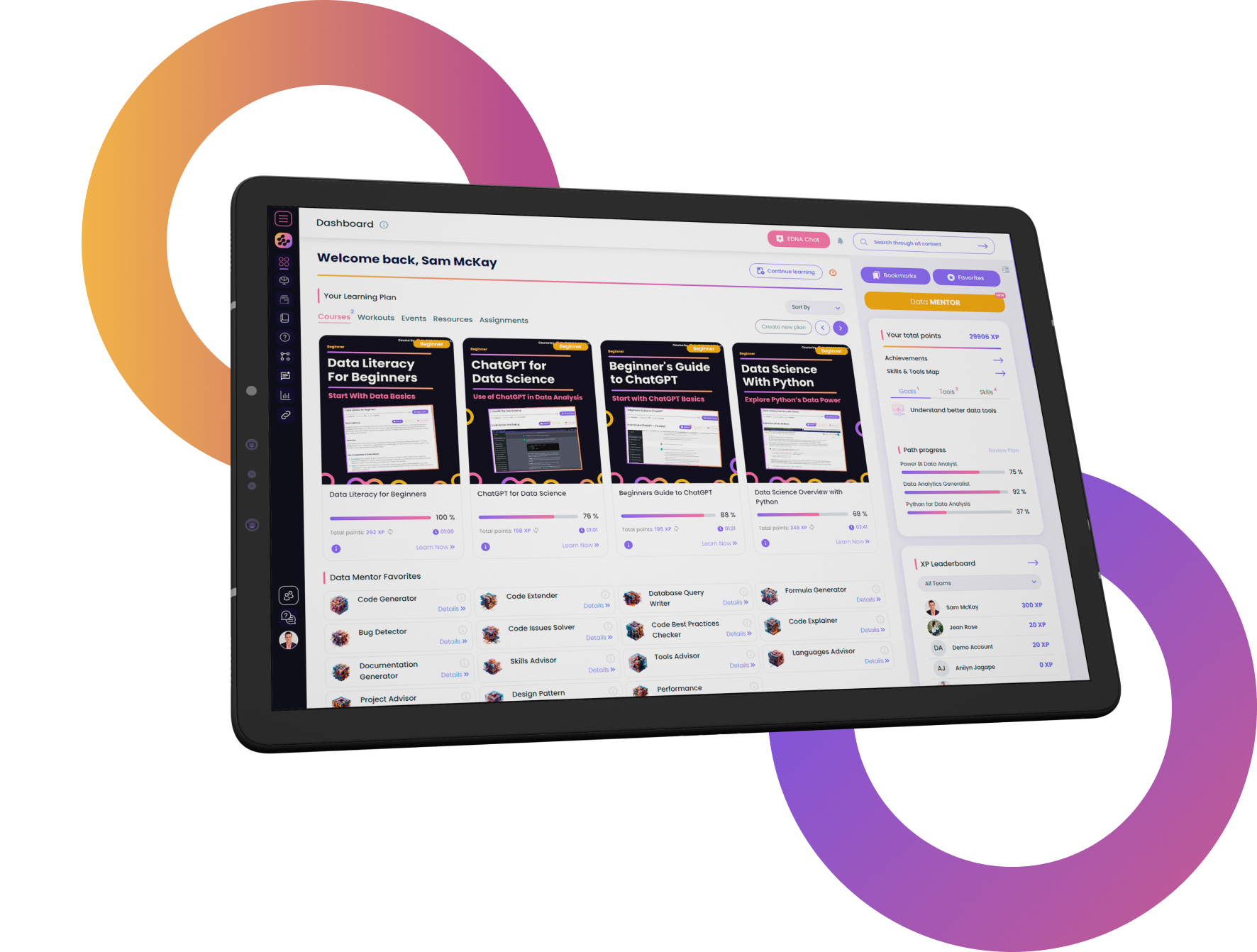

Enterprise DNA

For Individuals

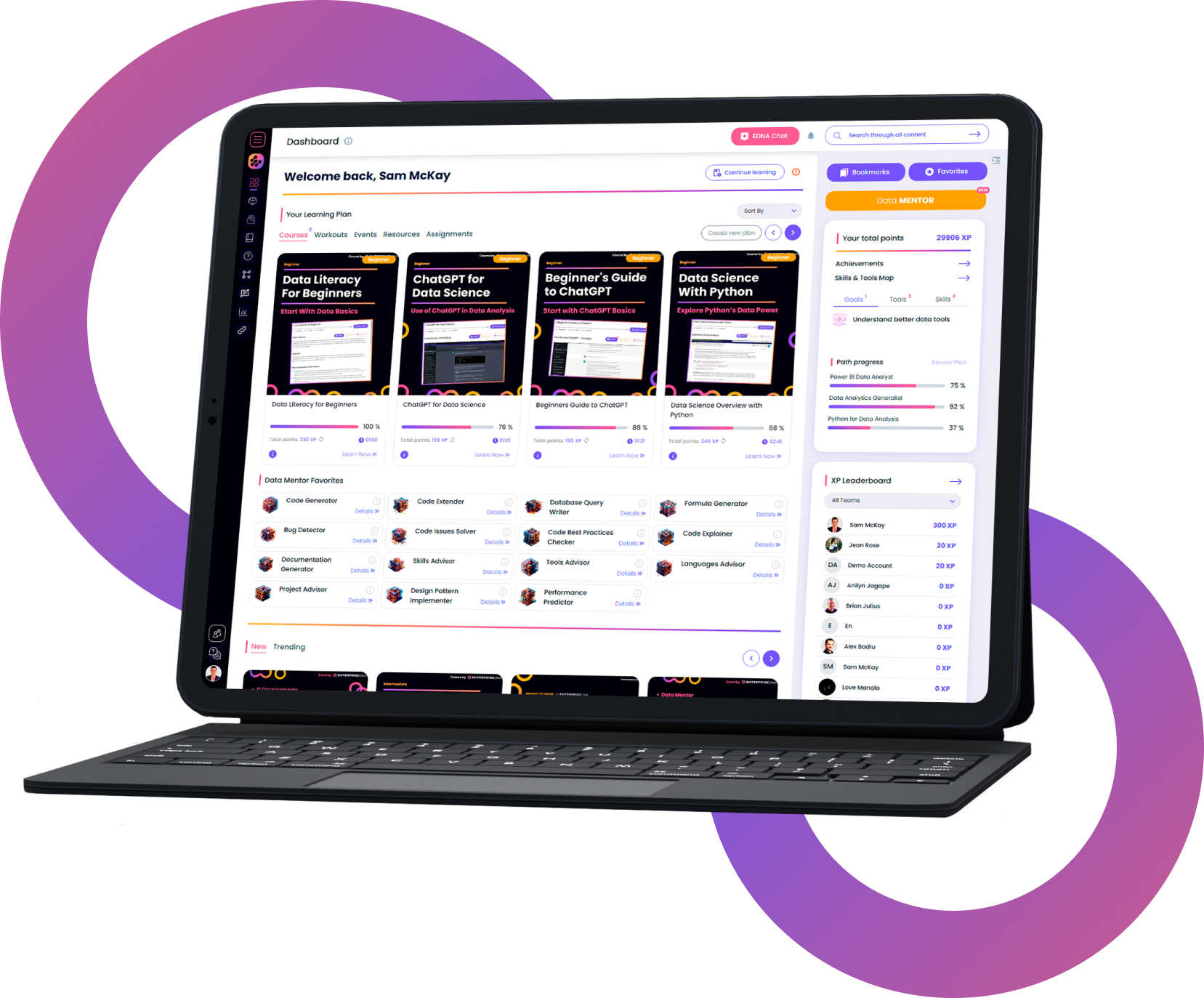

Empowering the most valuable data analysts to expand their analytical thinking and insight generation possibilities.

Learn MoreFOR BUSINESS

Enterprise DNA

For Business

Training, tools, and guidance to unify and upskill the data analysts in your workplace.

Learn More